- 24/7 Water Damage Emergency

- Direct Insurance Billing

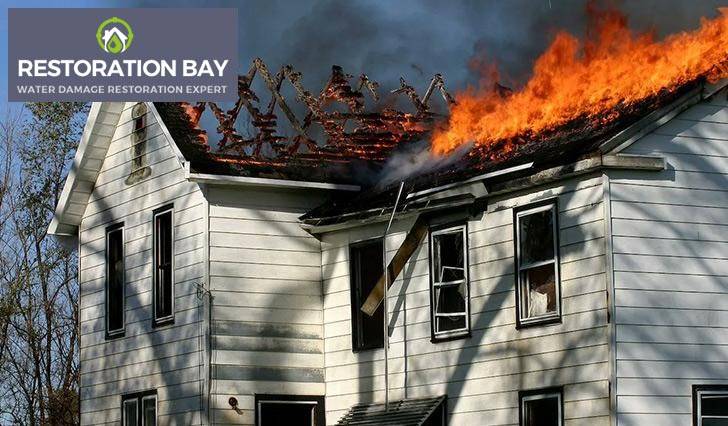

Data from the US Fire Administration shows each year, they respond to 368,500 residential fires across the country. Fires cause about 2,770 deaths and more than $8 billion in property damage. So, fire can strike anytime, anywhere.

Your homeowner policy is most likely to cover most of the damages caused by fire. However, the direct damage caused by fire is not the only thing that you should worry about. Here are some of the other kinds of damage that are caused by fire.

|

Smoke Damage |

Smoke can dissipate rather quickly, but it can easily make its way into other areas of the home and remain toxic for weeks or perhaps months. |

|

Water Damage |

The water used by firemen to combat the flames can cause more damage to the property. It will absorb into your walls & floorboards making them swell and wrap. It could lead to rot or plaster falling off. |

|

Soot Damage |

The property interiors may suffer from soot damage. It is visually unpleasant and can leave a nasty odor. It can also create health problems for family members. |

These are some of the damages you need to check for when you are assessing your fire damage. You can get in touch with a Bay Area public adjuster who would help you with the proper assessment of the damage. Contact our team to learn more about how to assess and prepare the report for your assessment.

When you are looking to make the claim settlement quick and easy, you should follow a few simple tips. One of the first things that you should know is when you should file the claim for fire damage.

Your insurance company will need prompt notice. So, you would need to inform them right away after suffering damage.

When you are making an initial request, you would need to make sure that you submit the following documents:

To file the claim, you will need to provide them with the details about the incident, including the date and the current condition of the home after the damage. If you have to live elsewhere, like in a hotel, then you can ask them whether they can provide advance payment under the Additional Living Expense (ALE) Coverage.

There is a lot of information that you need to provide your insurer. You can call us, and we will walk you through the process.

More often than not, your home might not be safe to live in. In such cases, you would have to live in a hotel. When you were evacuating, you might not be able to take essential items with you. Sometimes, those things might have been lost in the fire forever.

To deal with such expenses, you can request an advance. The insurer will be delivering the check to where you are staying. This will not only help you meet your day-to-day expenses, but you will also be able to make emergency repairs to your damaged property.

Remember, this advance will be deducted from the total amount you receive from the insurance company, so don’t request a large advance amount.

You should keep in mind not to remove anything before you call your insurance company. You might need to appoint schedule an appointment with the adjuster or get a public adjuster in Bay Area before you remove your belonging. Even if your belonging is unsalvageable, you will still need to present them, as they might reject the claims on certain grounds.

Restoration Bay is one of the most experienced contractors who helps you with fire damage insurance claims in the Bay Area. Here are some of the advantages that you get when you get our help with your insurance claim.

As a Bay Area public adjuster, we have the required knowledge to manage your homeowner’s insurance claim on your behalf, thereby making the job easier.

Making the process simpler, we make the process faster. So, getting in touch with a professional Bay Area Public Adjuster like Restoration Bay will help you settle claims quickly.

When you are working with us, we will make every effort to ensure that you get the higher claim amount you actually deserve, avoiding all the pitfalls that might get the claims rejected.

We know what information is required at which stage, and we ensure that we provide the insurance company with the information that they need. This makes the process easy and efficient.

When you are dealing with insurance, there is a ton of paperwork that you need to complete to get the claim. We would assist you with getting all the paperwork in order to get the claim settled.

The time taken for fire damage restoration depends on the extent of the damage. In most cases, it takes from a few days to up to a week.

Yes, we would help you take care of the insurance claims process. However, at certain stages, your presence would be required.

In most cases, you might be able to live in your home while restoration work is being done. However, if extensive parts of your home is damaged, then you might have to live elsewhere.